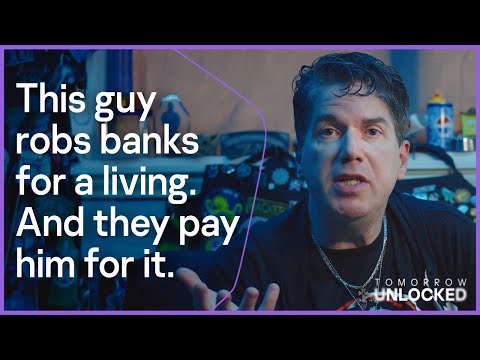

In the neon-drenched back alleys of the digital world, where code whispers secrets and firewalls stand as flimsy barricades, there are those who navigate the shadows not to pillage, but to protect. Jayson E. Street is one such architect of security, a man who finds the keys to the kingdom by breaking into its most guarded vaults. For him, and for a select cadre of elite penetration testers, the act of "hacking" isn't a crime; it's a form of intense, high-stakes problem-solving that fortifies the very systems it probes.

This isn't about wanton destruction. It’s about a profound understanding of mechanics, a relentless curiosity to push boundaries, and an almost primal human drive to challenge the established order. Street embodies this ethos, transforming complex financial institutions into his personal testing grounds. His daily grind involves venturing into forbidden digital territories, employing the dark arts of social engineering and sophisticated hacking techniques, all in pursuit of the elusive weaknesses that lurk within a bank's defenses. He is, by all accounts, one of the most sought-after security minds in the industry, a ghost in the machine ensuring that the titans of finance remain unbreached by less scrupulous actors.

The Hacker's Mindset: Curiosity as the Ultimate Weapon

The popular narrative often paints hackers as purely destructive forces, agents of chaos in the digital ether. But this is a crude caricature. For professionals like Jayson E. Street, the hacker’s mindset is rooted in an insatiable curiosity—a desire to dissect, understand, and ultimately improve. It’s the same spirit that drove early innovators to tinker with machines, that compels children to ask "why?" a thousand times, and that fuels the relentless pursuit of knowledge. In the realm of cybersecurity, this innate human quality is not a liability, but the most potent weapon in the arsenal of defense.

Street's approach is a testament to this philosophy. He doesn't just look for vulnerabilities; he dissects the entire ecosystem of a bank's digital infrastructure. This requires a deep dive into not only the technical architecture but also the human element – the social engineering vector that often proves to be the weakest link. Understanding how systems are integrated, how people interact with them, and where the logical gaps lie are all part of the intricate chess match he plays. It's a game where the stakes are astronomically high: the security of financial assets and the trust of millions.

From Intrusion to Fortification: The Pentester's Workflow

The life of a penetration tester, particularly one focused on the high-stakes environment of banking, is far from the simplistic portrayal often seen in media. It's a meticulously planned, ethically guided, and technically profound process. Street's work is a prime example of this complex dance between intrusion and fortification.

Phase 1: Reconnaissance and Target Analysis

Before any digital lock is even touched, an elite pentester like Street dedicates significant time to reconnaissance. This involves actively and passively gathering information about the target institution. This can range from publicly available data – domain registrations, employee lists on professional networks, press releases – to more active probing, like network scanning (with explicit permission) to map out the attack surface. Understanding the bank's technology stack, its geographic distribution, and even its corporate culture can provide crucial insights into potential vulnerabilities.

Phase 2: Vulnerability Identification and Exploitation

With a clear picture of the target, the penetration phase begins. This is where Street’s expertise truly shines. It involves employing a wide array of techniques:

- Network Penetration: Identifying and exploiting weaknesses in firewalls, network devices, and internal network segmentation.

- Web Application Hacking: Targeting web-based services with techniques like SQL Injection, Cross-Site Scripting (XSS), and Broken Authentication.

- Social Engineering: Manipulating individuals within the organization to gain access or information, often through phishing simulations or pretexting.

- Wireless Network Attacks: Assessing the security of Wi-Fi networks used by employees or customers.

- Physical Security Assessments: In some cases, and with client agreement, analyzing physical access controls to sensitive areas housing IT infrastructure.

The goal here isn't to cause damage, but to demonstrate *how* an attacker could cause damage. Each successful intrusion is a proof of concept (PoC) that highlights a critical flaw.

Phase 3: Post-Exploitation and Privilege Escalation

Once initial access is gained, the work is far from over. The next critical step is privilege escalation—moving from a low-level user account to a higher-privilege one, often administrative or system-level access. This allows the pentester to explore deeper into the network and understand the full extent of compromise possible. This phase also involves establishing persistence, demonstrating how an attacker could maintain access over time, a critical concern for financial institutions.

Phase 4: Reporting and Remediation Guidance

The most crucial phase, and the one that truly differentiates a destructive hacker from a valuable pentester, is the reporting. Street and his peers don't just break in; they meticulously document every step, every vulnerability found, and the potential impact. This report isn't just a list of problems; it's a blueprint for security improvement. It provides actionable recommendations, prioritizing risks and guiding the institution on how to best allocate resources to patch vulnerabilities, strengthen defenses, and train personnel.

The Economic Imperative: Why Banks Pay Hackers

It might seem counterintuitive, but banks actively hire individuals like Jayson E. Street because ignoring the threat is far more expensive than engaging with it proactively. The cost of a successful data breach – in terms of financial loss, regulatory fines, reputational damage, and customer churn – can be catastrophic. Hiring elite penetration testers is a strategic investment in risk mitigation. They simulate real-world attacks, providing invaluable insights that internal security teams, often constrained by operational focus, might miss.

This is a domain where the offensive perspective is paramount. To defend effectively, one must think like an attacker. Understanding exploitation techniques, attacker methodologies (like those outlined in the MITRE ATT&CK framework), and the psychological levers of social engineering are non-negotiable skills. For this reason, many financial institutions actively scout for talent with offensive security backgrounds, recognizing that these individuals possess the unique skillset required to identify and neutralize advanced threats.

Arsenal of the Elite Operator

The tools of the trade for a modern penetration tester are sophisticated and constantly evolving. While creativity and deep understanding are paramount, the right arsenal can significantly amplify effectiveness. For professionals operating in high-stakes environments like banking, several key categories of tools and resources are indispensable:

- Comprehensive Penetration Testing Suites: Tools like Burp Suite Professional (a must-have for web application testing), Metasploit Framework (for exploit development and execution), and Nmap (for network discovery and security auditing) are foundational. While free versions exist, the professional editions offer advanced features crucial for thorough assessments.

- Custom Scripting and Automation: Proficiency in languages like Python is essential for automating repetitive tasks, developing custom exploits, and processing large datasets from reconnaissance. Jupyter Notebooks are invaluable for data analysis and creating detailed reports.

- Social Engineering Toolkits: Platforms like SET (Social-Engineer Toolkit) and custom phishing frameworks allow for realistic simulations to test human elements of security.

- Intelligence Gathering Tools: OSINT (Open-Source Intelligence) frameworks and specialized search engines can uncover critical information about a target.

- Virtualization and Sandboxing: Environments like VMware Workstation or VirtualBox are used to create isolated testing labs, preventing accidental damage to production systems or the pentester's own machine.

- Essential Reading: For anyone serious about this field, books like "The Web Application Hacker's Handbook" and "Hacking: The Art of Exploitation" are considered seminal texts. Staying current with research papers and exploit databases (like Exploit-DB) is also critical.

- Certifications: While not always mandatory, certifications like the OSCP (Offensive Security Certified Professional) are highly regarded as they demonstrate practical, hands-on hacking skills. For broader enterprise security knowledge, the CISSP (Certified Information Systems Security Professional) is often a valuable complement.

Veredicto del Ingeniero: ¿Vale la pena la adopción?

The methodology employed by elite penetration testers like Jayson E. Street isn't just a service; it's a fundamental component of any robust cybersecurity strategy, especially in sensitive sectors like finance. Investing in professional penetration testing offers unparalleled insight into an organization's true security posture. It moves beyond theoretical compliance to practical, demonstrable risk validation. The return on investment is measured not in immediate profit, but in the prevention of potentially catastrophic losses and the preservation of trust. For banks and any organization handling critical data, adopting this offensive mindset through skilled professionals is not optional—it's a prerequisite for survival in the modern threat landscape.

Preguntas Frecuentes

- What is the primary goal of a penetration tester in a banking environment?

The primary goal is to identify and demonstrate security vulnerabilities within the bank’s systems and infrastructure in a controlled and ethical manner, providing actionable recommendations for remediation to prevent actual cyberattacks. - How does social engineering fit into banking penetration tests?

Social engineering is a critical component as human error or manipulation is often the weakest link. Pentesters simulate attacks like phishing or pretexting to test employee awareness and organizational security policies. - Is it legal for hackers to test bank security?

Yes, but only when conducted with explicit, written permission from the bank. Unauthorized access is illegal. Professional penetration testers operate under strict contractual agreements. - What are the key differences between ethical hacking and malicious hacking?

The core difference lies in intent and authorization. Ethical hackers have explicit permission and aim to improve security. Malicious hackers act without permission with intent to cause harm or profit illegally.

El Contrato: Fortify Your Digital Vault

You've seen how the shadows can be illuminated, how breaching can solidify. Now, the contract is laid bare. Your challenge is to apply this knowledge. Imagine you are tasked with assessing the security of a small, online-only credit union that processes customer deposits and withdrawals. What are the first three *offensive* steps you would take to understand their potential exposures, assuming you have their explicit, written consent to perform a penetration test? Detail your approach, focusing on techniques that leverage both technical prowess and an understanding of human behavior.

Share your strategy in the comments below. Let's see who can architect the most resilient defense by understanding the offensive blueprint.

No comments:

Post a Comment