The hum of a failing ATM isn't just the sound of mechanical decay; it’s often a siren song for opportunity. In the shadowed alleys of the digital underworld, where data is currency and access is king, understanding the vulnerabilities of physical-digital interfaces is paramount. Many see ATMs as mere cash dispensers, but to the keen eye, they are complex systems ripe for exploitation. This isn't about emptying accounts; it’s about dissecting the architecture, understanding the attack vectors, and appreciating the security implications of systems we interact with daily. Today, we’re not just looking at code; we’re looking at the circuitry and software that guard the physical world’s financial conduits.

When we talk about ATM hacking, the immediate thought might be sophisticated hardware implants or zero-day exploits in proprietary software. While those methods exist, the true art lies in finding the cracks in the foundation, the overlooked entry points that don't require a seven-figure budget. It's about leverage. It's about understanding common configurations, default credentials, and the human element that often bridges the physical and digital divide. This guide is designed to illuminate those paths, not for malicious intent, but for the defender who needs to anticipate the attacker’s every move.

Understanding the ATM Attack Surface

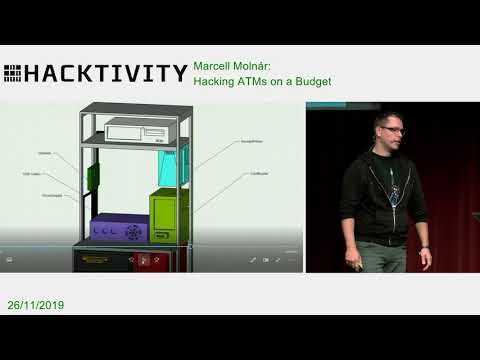

An ATM is a confluence of hardware and software, each presenting its own set of vulnerabilities. The exterior, seemingly robust, can hide physical entry points. Internal components, often running standard operating systems, are susceptible to traditional software exploits. The network connectivity, bridging the ATM to financial institutions, is another critical vector.

Physical Entry Points

- Hardware Tampering: Unauthorized access to physical ports (USB, diagnostic ports) can allow for direct interaction with the system.

- Card Skimmers & Keypads: Although often associated with consumer-level fraud, advanced techniques can exploit these to capture data and commands.

- Cash Dispenser Mechanisms: Exploiting the mechanical and software controls of the dispenser itself can lead to dispensing errors or unauthorized access.

Software Vulnerabilities

- Operating System Exploits: Many ATMs run older or unpatched versions of Windows or Linux. Default credentials, known exploits, and weak configurations are common.

- Application-Level Flaws: The ATM software itself, managing transactions, user interfaces, and network communication, can harbor critical bugs.

- Firmware Manipulation: Tampering with firmware can alter the device’s behavior at a fundamental level.

Network & Communication Channels

- Unsecured Network Connections: ATMs often communicate over networks that may not be adequately segmented or secured, allowing attackers to intercept or inject traffic.

- Weak Authentication Protocols: The communication channels between the ATM and the bank’s servers can sometimes be protected with outdated or easily bypassed authentication mechanisms.

The "Budget" Approach: Tools and Techniques

The "budget" in ATM hacking doesn't mean using cheap, ineffective tools. It means employing inexpensive, readily available, or repurposed components and software to achieve significant results. This often involves leveraging open-source intelligence (OSINT) and common, accessible hardware.

Leveraging Open-Source Intelligence (OSINT)

Before any physical interaction, OSINT is your primary weapon. Understanding the ATM model, its typical operating system, and known vulnerabilities can save immense time and resources.

- Model Identification: Identifying the manufacturer (e.g., Diebold Nixdorf, NCR, Wincor Nixdorf) and specific model is the first step.

- Online Databases: CVE databases, security forums, and leaked security documentation can provide critical insights into known vulnerabilities for specific models.

- Publicly Available Manuals: Service manuals, often available online, can detail diagnostic ports, default settings, and internal layouts.

Hardware for the Operator

You don't need a $10,000 hardware lab. Common electronics and programming tools suffice for many budget-friendly attacks.

- Raspberry Pi / Arduino: These single-board computers are invaluable for creating custom interfaces, automating tasks, or acting as a bridge for communication interception.

- USB Drives: Loaded with specialized bootable operating systems (e.g., Kali Linux, Tails) or custom scripts, these are your portable workstations.

- Universal Programmer: For manipulating firmware chips directly, a cheap universal programmer can be a game-changer.

- Basic Toolkit: Screwdrivers, pliers, and ideally, a non-conductive pry tool for physical access.

Software and Exploitation Frameworks

The software side relies heavily on existing, often free, tools.

- Kali Linux / Parrot OS: These distributions come pre-loaded with a vast array of security tools suitable for network analysis, exploitation, and password cracking.

- Metasploit Framework: While often associated with network penetration testing, its modules can sometimes be adapted or provide inspiration for ATM-specific exploits.

- Custom Scripts (Python, Bash): Automating repetitive tasks, brute-forcing credentials, or interacting with specific hardware protocols is where custom scripting shines.

A Walkthrough: Exploiting a Common Vulnerability (Hypothetical Scenario)

Let's consider a common scenario: an ATM running an older version of Windows with a physical USB port accessible. This is a classic vector for a budget-minded operator.

Phase 1: Reconnaissance and Preparation

- OSINT: Identify the ATM model. Search for known vulnerabilities related to its OS version (e.g., Windows XP, Windows 7 Embedded). Look for service manuals detailing USB port functionality.

- Tool Preparation: Create a bootable USB drive with Kali Linux. Pre-load it with tools like `nmap` (for network scanning if connected), `hydra` (for brute-forcing logins if applicable), and custom Python scripts to interact with storage devices.

- Physical Assessment: During a low-traffic period, discreetly assess the ATM. Is the USB port exposed? Is it locked or accessible? For this scenario, we assume it's accessible.

Phase 2: Initial Access

- Physical Access: Insert the prepared USB drive into the accessible port.

- Boot Override: If possible, initiate a reboot of the ATM (often through a specific button sequence or a brief power interruption if feasible and discreet). Configure the ATM's BIOS/UEFI (if accessible) to boot from USB. *Note: This step is highly dependent on the ATM's configuration and security hardening.*

- Gaining a Shell: Once booted into Kali Linux from the USB, you have a live operating system within the ATM. The next step is to gain persistence or access the ATM's internal storage.

Phase 3: Post-Exploitation (Budget Edition)

- Data Exfiltration: Mount the ATM's internal hard drive or SSD. Search for sensitive configuration files, database backups, or user credential hashes.

- Credential Harvesting: If the system uses standard Windows logins, attempt to dump password hashes using tools like `mimikatz` (run from the live USB environment) or by directly accessing SAM files.

- Network Pivoting: If the ATM is connected to a network, use the live environment to scan the local network for other vulnerable devices or gain access to the internal banking network.

- Persistence: To maintain access, you might copy essential files to a hidden partition, set up scheduled tasks, or even attempt to inject a small, stealthy rootkit. For a budget approach, a simple script that periodically phones home with collected data might suffice.

This walkthrough highlights how a common OS vulnerability and accessible hardware can be exploited with minimal investment. The key is understanding the system's layers and finding the weakest one.

The "Why": Motivations Beyond Simple Theft

While financial gain is a common motivator, understanding ATM vulnerabilities serves several critical purposes for security professionals.

- Defensive Security Testing: Identifying these weaknesses allows financial institutions to patch systems, implement more robust security measures, and train staff.

- Incident Response Preparedness: Knowing how an ATM can be compromised helps incident response teams develop better detection and containment strategies.

- Research and Education: Documenting these attack vectors contributes to the collective knowledge base of cybersecurity, enabling better defenses for everyone.

Veredicto del Ingeniero: ¿Vale la pena adoptarlo?

From a purely technical standpoint, delving into ATM vulnerabilities is a masterclass in system security. It forces you to think cross-functionally – bridging hardware, firmware, operating systems, and network protocols. The "budget" aspect emphasizes ingenuity and resourcefulness, qualities essential in any security role. While direct exploitation of ATMs is illegal and carries severe penalties, understanding these principles is invaluable for anyone involved in securing critical infrastructure or advanced penetration testing. It’s not about the act itself, but the comprehensive knowledge gained. The complexity and interconnectedness of these systems make them fascinating targets for study, revealing the often-overlooked pathways that attackers can exploit.

Arsenal del Operador/Analista

- Hardware: Raspberry Pi 4, Arduino Uno, Cheap USB Rubber Ducky / BadUSB variants, Universal BIOS Programmer, Basic Electronics Toolkit.

- Software: Kali Linux, Metasploit Framework, Mimikatz, Python (for scripting), Nmap, Hydra.

- OSINT Tools: Shodan, Censys, Google Dorks, Public CVE Databases (NVD, MITRE).

- Books: "The Art of Exploitation" by Jon Erickson, "Hacking: The Art of Exploitation" (2nd Edition) by Jon Erickson, "Mobile Application Penetration Testing" by Olivia Ruane (for conceptual parallels in mobile interfaces).

- Certifications: OSCP (Offensive Security Certified Professional) is highly regarded for demonstrating hands-on exploitation skills, which are transferable.

Preguntas Frecuentes

- Q: Is it possible to hack an ATM without any physical access?

A: While purely remote attacks are much harder and often target the network infrastructure connecting ATMs, physical access significantly lowers the barrier to entry and increases the likelihood of success for many attack types. - Q: Are all ATMs equally vulnerable?

A: No. Newer ATMs with hardened operating systems, encrypted communication, and regular security updates are significantly more difficult to compromise than older models. - Q: What is the most common "budget" attack vector on ATMs?

A: Exploiting physical access to USB ports with bootable media or using compromised card readers/keypads remain prevalent methods due to their relative simplicity and effectiveness against less secured machines. - Q: How can banks prevent these types of attacks?

A: Regular hardware and software patching, strong physical security, network segmentation, using modern encryption, disabling unnecessary ports, and employing intrusion detection systems are crucial.

El Contrato: Asegura el Perímetro

Your mission, should you choose to accept it, is to analyze your local ATMs. Not to hack them, but to understand their external posture. Identify the manufacturer and model if possible. Note the physical ports visible. Research common vulnerabilities for ATMs of that age or type using OSINT. Document your findings (without any illegal activity, of course). The goal is to apply the reconnaissance phase discussed herein. Understanding the attack surface is the first step to building an impenetrable defense. Share your findings on the public posture and potential vulnerabilities you could identify through public means in the comments below.

For more insights into the cutting edge of cybersecurity and offensive techniques, visit Sectemple.

Explore other facets of knowledge at my linked blogs: El Antroposofista, El Rincón Paranormal, Gaming Speedrun, Skate Mutante, Budo y Artes Marciales, Freak TV Series.

Discover unique digital assets at: Mintable NFTs.