Table of Contents

- Introduction: The Ghost in the Digital Machine

- Core Concepts: The Pillars of Bitcoin

- Blockchain Architecture: A Distributed Ledger

- The Transaction Lifecycle: From Creation to Confirmation

- Mining and Consensus: Securing the Network

- Cryptographic Primitives: The Foundation of Trust

- Practical Implementation: Tracing a Bitcoin Transaction

- Operator's Arsenal: Tools for the Digital Detective

- Engineer's Verdict: Is Bitcoin's Architecture Future-Proof?

- Frequently Asked Questions

- The Contract: Securing the Digital Frontier

Introduction: The Ghost in the Digital Machine

The flickering cursor on the dark terminal was my only companion as the network logs spewed an anomaly. Something that shouldn't be there. It wasn't a system breach in the traditional sense, no brute-force attack or exposed API. It was subtler, a whisper of distributed consensus gone awry, a phantom in the digital machine. Today, we're not patching a server; we're performing a digital autopsy on the very architecture that underpins Bitcoin. Forget the hype of volatile prices for a moment. We need to strip it down, understand the gears, the levers, the cryptographic magic that makes this decentralized ledger tick. This isn't just about cryptocurrency; it's about understanding a paradigm shift in trust and transaction.

The world of blockchain can appear opaque, a black box where digital coins materialize and disappear. But beneath the surface lies a meticulously engineered system, a testament to cryptographic ingenuity and distributed systems design. Understanding Bitcoin is not about memorizing its price charts; it's about dissecting its protocol, understanding the incentives, and appreciating the robust security mechanisms that have allowed it to endure. This deep dive will equip you with the analytical framework to pierce through the obfuscation and grasp the fundamental mechanics at play.

Core Concepts: The Pillars of Bitcoin

At its heart, Bitcoin is a proof-of-concept for a decentralized, peer-to-peer electronic cash system. This means no central bank, no single point of control, and transactions validated by a global network of participants. The core tenets are deceptively simple:- Decentralization: Power and control are distributed across a network, eliminating reliance on a single authority.

- Transparency: All transactions are recorded on a public ledger, visible to anyone.

- Immutability: Once a transaction is confirmed and added to the blockchain, it cannot be altered or deleted.

- Scarcity: The total supply of Bitcoin is capped at 21 million coins, enforced by the protocol.

- Pseudonymity: Transactions are linked to Bitcoin addresses, not directly to personal identities, offering a degree of privacy.

These principles, when woven together, create a system that is resilient, censorship-resistant, and fundamentally changes how we perceive digital value transfer. The security and integrity of this system rely heavily on cryptographic primitives and a game-theoretic consensus mechanism.

Blockchain Architecture: A Distributed Ledger

The term "blockchain" is literal. It's a chain of blocks, where each block contains a batch of validated transactions. Imagine a digital ledger, duplicated and distributed across thousands of computers worldwide.- Blocks: Each block is a data structure containing a list of transactions, a timestamp, and a cryptographic hash of the preceding block. This hash is what links blocks together, forming the chain.

- Ledger: The entire history of all Bitcoin transactions is stored on this distributed ledger. Every participant on the network has a copy, ensuring redundancy and preventing single points of failure.

- Distributed Nature: The ledger isn't stored in one central location. It's replicated across a peer-to-peer network. This distribution is key to its resilience against censorship and attacks.

This distributed ledger is the backbone, the immutable record that everyone trusts because everyone verifies. It’s a system where trust is not placed in an intermediary but in the collective verification of the network.

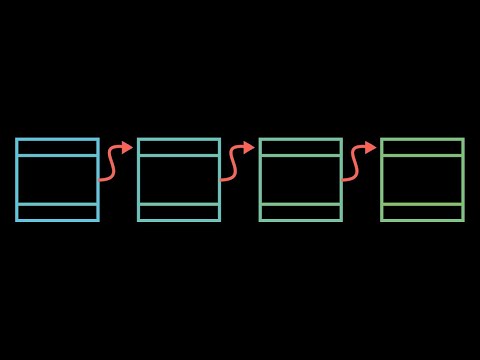

The Transaction Lifecycle: From Creation to Confirmation

When you initiate a Bitcoin transaction, a complex ballet of digital processes begins:- Transaction Creation: You use your Bitcoin wallet to create a transaction, specifying the recipient's address and the amount. This transaction is digitally signed using your private key, proving ownership of the Bitcoin being sent.

- Broadcasting: The signed transaction is broadcast to the Bitcoin peer-to-peer network.

- Mempool: Unconfirmed transactions are held in a waiting area called the "mempool" (memory pool).

- Mining and Inclusion: Miners, who are participants validating transactions and securing the network, pick up transactions from the mempool to include in the next block they are trying to create.

- Block Creation: Miners compete to solve a computationally intensive puzzle. The first one to solve it gets to add their block of transactions to the blockchain.

- Confirmation: Once a block is added, the transactions within it are considered to have one confirmation. As subsequent blocks are added on top of this block, the number of confirmations increases, making the transaction progressively more irreversible. A transaction is generally considered final after 6 confirmations.

The incentive for miners to perform this work is the reward of newly minted Bitcoin and transaction fees. This economic model aligns their interests with the health and security of the network.

Mining and Consensus: Securing the Network

Mining is the process by which new Bitcoin transactions are verified and added to the blockchain, and it's also how new Bitcoins are created. This is governed by a consensus mechanism called Proof-of-Work (PoW).- Proof-of-Work: Miners expend computational power to solve a complex cryptographic puzzle. This puzzle involves finding a number (a "nonce") that, when combined with the block's data and hashed, produces a hash value below a certain target threshold.

- Difficulty Adjustment: The difficulty of this puzzle is adjusted by the network approximately every two weeks to ensure that new blocks are found, on average, every 10 minutes, regardless of the total mining power on the network.

- Consensus: The longest chain is considered the valid chain. Miners are incentivized to build on the longest chain because that's where the rewards are. This collective agreement on the state of the ledger is the "consensus."

This PoW mechanism not only secures the network but also makes it incredibly expensive and difficult for any single entity to control or manipulate the blockchain. The sheer computational power required is a formidable barrier.

"The blockchain is an immutable record of truth. To alter it would require rewriting history itself, a feat no single entity can achieve."

Cryptographic Primitives: The Foundation of Trust

Bitcoin's security hinges on several fundamental cryptographic concepts:- Hashing: Bitcoin uses the SHA-256 hashing algorithm. A hash function takes an input of any size and produces a fixed-size output (a hash). It's deterministic (the same input always produces the same output) and collision-resistant (it's virtually impossible to find two different inputs that produce the same output). Hashes are used to link blocks and ensure data integrity.

- Public-Key Cryptography (Asymmetric Cryptography): This involves a pair of keys: a public key and a private key. Your public key is derived from your private key. You can share your public key freely (it forms your Bitcoin address), but your private key must remain secret. Your private key is used to sign transactions, and anyone can use your public key to verify that the signature is valid and that the transaction originated from you.

These primitives ensure that transactions are authenticated, authorized, and that the blockchain itself is tamper-evident. The security of the entire system is directly tied to the strength of these cryptographic foundations.

Practical Implementation: Tracing a Bitcoin Transaction

While we can't execute a mining operation on our laptops, we can gain practical insight by tracing a transaction on a block explorer. This is your first step into the operational side of understanding Bitcoin.Guide to Tracing a Bitcoin Transaction

- Find a Transaction ID (TxID): You'll need a unique identifier for the transaction. You can find ongoing discussions about transactions on forums, or if you've sent one, use your wallet's transaction history. For demonstration, search for a known transaction on a block explorer.

- Utilize a Block Explorer: Services like Blockchain.com, Blockchair, or Mempool.space act as interfaces to the Bitcoin blockchain. Navigate to one of these websites.

- Search for the TxID: Paste the TxID into the search bar of the block explorer.

-

Analyze Transaction Details: The explorer will display comprehensive information about the transaction:

- Inputs: Where the Bitcoin came from. You'll see the previous transaction outputs (UTXOs - Unspent Transaction Outputs) used to fund this transaction.

- Outputs: Where the Bitcoin is going. You'll see the recipient addresses and the amounts sent.

- Confirmation Status: How many confirmations the transaction has.

- Transaction Fee: The fee paid to the miners for processing the transaction.

- Block Height: The block number in which the transaction was included.

- Explore Linked Addresses: Click on the Bitcoin addresses involved. This will show you the transaction history and total balance associated with those addresses, giving you a map of the flow of funds.

- Examine Linked Blocks: From the transaction details, you can navigate to the block that confirmed it. This allows you to see all other transactions included in that same block, providing a snapshot of network activity at that time.

This exercise demystifies the process. You're no longer looking at abstract numbers but at a verifiable flow of value on a public, distributed ledger. This methodology is fundamental for forensic analysis of cryptocurrency movements.

Operator's Arsenal: Tools for the Digital Detective

To truly operate within the domain of blockchain analysis, you need the right tools. Forget the consumer-grade wallets; we're talking about the tools of the trade for investigators and analysts.- Block Explorers (Advanced): While basic ones are free, enterprise-grade explorers offer deeper analytics, visualization, and API access for programmatic querying.

- Specialized Blockchain Analysis Software: Tools like Chainalysis, Elliptic, or TRM Labs provide sophisticated analytics for tracing illicit funds, identifying suspicious patterns, and attributing activity to known entities. These are typically enterprise solutions, reflecting the seriousness of this field.

- Command-Line Bitcoin Nodes: Running your own Bitcoin Core node gives you direct access to the network, allowing for raw data analysis and verification without relying on third-party explorers. This is crucial for deep dives and ensuring data integrity.

- Programming Libraries (Python): Libraries like `python-bitcoinlib` or `blockcypher-python` enable you to programmatically interact with the blockchain, build custom analysis tools, and automate data collection.

- TradingView (for Market Analysis): While not strictly for on-chain analysis, its charting tools and community scripts are invaluable for correlating market movements with on-chain data.

- Books:

- Mastering Bitcoin: Programming the Open Blockchain by Andreas M. Antonopoulos: The definitive technical guide for understanding Bitcoin's internals.

- The Bitcoin Standard: The Decentralized Alternative to Central Banking by Saifedean Ammous: Provides economic context and a bullish perspective on Bitcoin's role.

- Certifications: While nascent, certifications in blockchain forensics or cryptocurrency analysis are emerging. For a broader security foundation, consider traditional certs like the OSCP or CISSP to understand the security context within which blockchain operates.

Investing in these tools and knowledge isn't just about curiosity; it's about developing the capability to navigate and interpret the digital currency landscape with expertise.

Engineer's Verdict: Is Bitcoin's Architecture Future-Proof?

Bitcoin's architecture is a marvel of distributed systems and cryptography, having withstood the test of time and scale for over a decade. Its core design, rooted in Proof-of-Work and a decentralized ledger, has proven remarkably robust and secure. Pros:- Unparalleled Decentralization: Achieved through a massive, distributed network of nodes and miners.

- Robust Security: Proof-of-Work makes tampering economically infeasible.

- Immutability: Once confirmed, transactions are practically irreversible.

- Proven Track Record: Decades of operation without major protocol-level security failures.

- Economic Incentives Alignment: Miners are incentivized to act honestly.

- Scalability Limitations: The block size and block time limit transaction throughput, leading to higher fees and longer confirmation times during periods of high demand.

- Energy Consumption: Proof-of-Work is notoriously energy-intensive, raising environmental concerns.

- Irreversibility (Double-Edged Sword): Lost private keys mean lost funds forever, with no recourse.

- Complexity: Understanding and interacting with Bitcoin at a deep technical level requires significant expertise.

Frequently Asked Questions

Q1: How is Bitcoin different from traditional currencies?

A1: Bitcoin is decentralized, meaning no single entity controls it. Traditional currencies are issued and controlled by central banks. Bitcoin transactions are recorded on a public, immutable blockchain, whereas traditional transactions are managed by private financial institutions.

Q2: Is Bitcoin mining profitable?

A2: Mining profitability depends on several factors, including the price of Bitcoin, mining hardware efficiency, electricity costs, and the network's mining difficulty. It's a highly competitive and capital-intensive endeavor.

Q3: Can I lose my Bitcoin?

A3: Yes. If you lose your private keys, you lose access to your Bitcoin forever. Similarly, if you send Bitcoin to the wrong address, it's typically unrecoverable. This underscores the importance of secure key management.

Q4: What is the Lightning Network, and how does it relate to Bitcoin?

A4: The Lightning Network is a "Layer 2" scaling solution built on top of the Bitcoin blockchain. It allows for faster, cheaper transactions by creating off-chain payment channels between users, only settling the final net balance on the main blockchain.

The Contract: Securing the Digital Frontier

You've peered into the engine room of Bitcoin, dissected its anatomical structure, and understood the cryptographic whispers that ensure its integrity. Now, the real work begins.The Contract: Securing the Digital Frontier

Imagine you are tasked with analyzing a complex series of cryptocurrency transactions suspected of being linked to an illicit operation. Your objective is to trace the flow of illicit funds from their origin within a known darknet marketplace to their potential conversion into fiat currency through the use of multiple, interconnected exchanges and privacy-focused mixers.

Using the principles and tools discussed in this analysis:

- Hypothesize: Outline a potential flow of funds, identifying key steps and potential points of obfuscation (e.g., using mixers, chain hopping between cryptocurrencies).

- Execute (Simulated): Describe how you would use a combination of advanced block explorers and, hypothetically, blockchain analysis software to follow the trail. What specific data points would you look for at each stage?

- Identify Weaknesses: Pinpoint the vulnerabilities or limitations in Bitcoin's pseudonymous nature that are exploited in such scenarios. Conversely, identify the inherent strengths of the blockchain that ultimately allow for tracing.

- Report: Summarize your methodology and the expected challenges you would face in definitively linking the cryptocurrency movements to a specific real-world entity.

This isn't a theoretical exercise. It's the reality faced by digital forensics experts and cybersecurity analysts every day. The blockchain, for all its transparency, is a complex labyrinth. Can you navigate it?