The hum of the servers was a low thrum against the silence of the predawn hours. Not the sound of prosperity, but the whisper of ghosts in the machine. In 2016, a phantom moved through the global financial arteries, a threat so audacious it threatened to rewrite the rules of digital warfare. The Bangladesh Bank Heist wasn't about brute force; it was about exploiting the unseen vulnerabilities in trust and protocol. Today, we dissect not just an attack, but a cautionary tale etched in keystrokes and a typo.

The Bangladesh Bank Heist: The Anatomy of a Near Billion-Dollar Cyber Heist

In the shadowy corners of the digital realm, where exploits are currency and vulnerability is a business model, the 2016 Bangladesh Bank Heist stands as a stark monument. Hackers, armed with little more than compromised credentials and audacious intent, came within a hair's breadth of siphoning nearly $1 billion from an unsuspecting central bank. This wasn't a smash-and-grab; it was a meticulously planned cyber infiltration, a chilling testament to how a few well-placed commands can bypass physical security and threaten global financial stability.

We'll peel back the layers of this incident, not to glorify the perpetrators, but to understand their methodology and, more importantly, to arm ourselves with the defensive strategies that could have, and should have, prevented it. This is about learning from the fallen dominoes.

The Attack Vector: Exploiting the SWIFT Network

At the heart of the Bangladesh Bank Heist lay the SWIFT (Society for Worldwide Interbank Financial Telecommunication) network. This isn't just a messaging system; it's the global nervous system for trillions of dollars in daily transactions. The attackers understood its critical role and its inherent trust model.

Their entry point was not a zero-day exploit in the SWIFT protocol itself, but a far more classic, yet devastatingly effective, technique: credential theft. By compromising the login details of authorized personnel within the Bangladesh Bank, the attackers gained the keys to the kingdom. These credentials were then used to issue a series of fraudulent fund transfer requests over the SWIFT network.

The initial plan was ambitious: divert almost $1 billion. The funds were directed towards accounts in the Philippines, a jurisdiction often cited in discussions about money laundering due to its regulatory landscape around casinos. While the ultimate goal was a near-complete extraction, fate, in the form of a simple typographical error, intervened.

The Typo That Saved $850 Million

In the chaotic rush of executing such a massive operation, a single misplaced character in a transaction request for $950 million brought the entire scheme crashing down. The error, insignificant to the untrained eye, was a glaring anomaly to automated monitoring systems and human oversight. This single mistake flagged the transaction, triggering an investigation and halting the transfer of the majority of the intended funds.

Make no mistake, however. Even with this critical slip-up, the hackers were successful in siphoning out $81 million, which was successfully funneled into four different accounts in the Philippines. From there, the money entered the opaque world of casino industry laundering, a common tactic to obscure the origin of illicit funds. This residual success underscores the sophistication of the attack and the difficulty in fully recovering stolen assets once they enter such complex financial ecosystems.

"The SWIFT system itself is designed for secure messaging, but its security relies on the integrity of the endpoints and the user credentials. A compromised endpoint with valid credentials is an open door." - cha0smagick

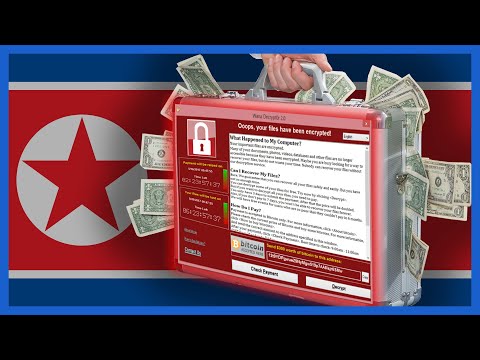

The Phantom Hackers: The Lazarus Group Connection

The identity of the architects behind this audacious heist remains, officially, a mystery. However, the fingerprints, or rather the digital modus operandi, strongly point towards the Lazarus Group. This state-sponsored hacking collective, allegedly operating under the North Korean regime, has a notorious reputation for lucrative cyber operations.

Lazarus is not a new player. Their history includes high-profile attacks, such as the infamous Sony Pictures hack in 2014. Their modus operandi often involves sophisticated social engineering, credential harvesting, and the exploitation of financial systems for ill-gotten gains. Billions of dollars laundered through various global financial institutions have been attributed to their activities, making them a persistent and significant threat to the global cybersecurity landscape.

The attribution to Lazarus is based on shared tactics, techniques, and procedures (TTPs) observed across multiple incidents. The level of planning, the technical execution, and the specific targeting of financial infrastructure align with their known capabilities. It serves as a stark reminder that cyber threats are not always random; they can be well-resourced, persistent, and state-backed.

The Aftermath: A Wake-Up Call for the Banking Industry

The Bangladesh Bank Heist was more than just a financial loss; it was a seismic shockwave that rippled through the global banking sector. It laid bare the vulnerabilities inherent in the SWIFT network and served as an undeniable wake-up call, emphasizing the urgent need for robust, multi-layered cybersecurity defenses.

In response, financial institutions worldwide began to re-evaluate and fortify their SWIFT transaction processes. Key changes implemented included:

- Enhanced Access Controls: Stricter protocols for who can authorize SWIFT transactions, often involving multiple individuals or roles.

- Multi-Factor Authentication (MFA): The mandatory deployment of MFA for accessing critical financial systems, ensuring that compromised credentials alone are insufficient for unauthorized access.

- Robust Password Policies: Enforcement of complex password requirements and regular password rotation to mitigate the risk of credential brute-forcing or reuse.

- Network Segmentation: Isolating SWIFT-related systems from less secure parts of the bank's network to limit lateral movement by attackers.

- Real-time Transaction Monitoring: Implementing advanced analytics and AI-driven systems to detect anomalous transaction patterns in real-time, much like the typo flagged in this case, but with broader scopes.

- Security Awareness Training: Investing heavily in training employees on phishing, social engineering, and the broader landscape of cyber threats, recognizing human error as a significant attack vector.

This heist underscored a fundamental truth: in the digital age, cybersecurity is not merely an IT concern; it is a core business imperative, directly impacting financial stability and public trust.

Arsenal of the Operator/Analyst

To effectively defend against sophisticated threats like the Bangladesh Bank Heist, operators and analysts need a robust toolkit and a deep understanding of threat intelligence.

- Threat Intelligence Platforms (TIPs): Tools like Anomali ThreatStream or ThreatConnect are crucial for aggregating, analyzing, and disseminating threat data, including known malicious IPs, domains, and TTPs associated with groups like Lazarus.

- Network Intrusion Detection/Prevention Systems (NIDS/NIPS): Solutions such as Snort or Suricata, configured with up-to-date rule sets, can help detect suspicious network traffic patterns indicative of reconnaissance or exfiltration.

- Endpoint Detection and Response (EDR): Platforms like CrowdStrike Falcon or Microsoft Defender for Endpoint offer deep visibility into endpoint activity, enabling the detection of malicious processes, file modifications, and network connections.

- Log Management and SIEM Solutions: Systems like Splunk or ELK Stack are essential for collecting, correlating, and analyzing logs from various sources, which is critical for forensic investigation and threat hunting.

- Secure SWIFT Connectivity Solutions: Many vendors offer specialized "SWIFT-certified" connectivity solutions that provide enhanced security features beyond standard SWIFT requirements.

- Security Awareness Training Platforms: Services like KnowBe4 or Proofpoint provide scalable solutions for educating employees on cyber hygiene and threat recognition.

Taller Defensivo: Fortaleciendo SWIFT Transaction Security

The Bangladesh Bank Heist highlighted specific weaknesses that can be addressed through proactive measures. Here’s a practical approach to fortifying SWIFT transaction security:

- Isolate Critical Systems: Ensure financial messaging systems, including SWIFT interfaces, are on a dedicated, hardened network segment with strict firewall rules. This segment should have minimal outbound connectivity, restricted only to necessary SWIFT network endpoints.

-

Implement Strong Authentication:

- Enforce Multi-Factor Authentication (MFA) for all access to SWIFT terminals and related administrative interfaces. Biometrics or hardware tokens are preferred over SMS-based MFA.

- Enforce complex, regularly rotated passwords for any accounts that have access to SWIFT-related systems.

-

Granular Access Control & Segregation of Duties:

- Define strict roles for initiating, authorizing, and supervising SWIFT messages. No single individual should possess complete control over a transaction lifecycle.

- Implement least privilege principles for all system access.

-

Real-time Transaction Monitoring and Alerting:

- Configure monitoring tools to flag transactions that deviate from established norms (e.g., unusual amounts, non-standard beneficiaries, transactions during off-hours).

- Set up alerts for failed login attempts, changes in system configurations, or unusual network activity originating from SWIFT terminals.

SecurityEvent | where TimeGenerated > ago(1d) | where EventID == 4624 // Successful logon | summarize count() by Account, ComputerName, IpAddress | where count_ > 10 // High number of successful logons from an IP | project Account, ComputerName, IpAddress, logon_count = count_ - Regular Vulnerability Assessments and Penetration Testing: Conduct frequent internal and external penetration tests specifically targeting the SWIFT infrastructure and its related access points.

- Endpoint Security Hardening: Ensure all endpoints with access to SWIFT systems are hardened according to security benchmarks, have up-to-date antivirus/anti-malware, and are subject to strict patch management. Disable unnecessary services and ports.

- Employee Training and Awareness: Regularly train staff on recognizing phishing attempts, social engineering tactics, and the importance of secure handling of credentials. Emphasize the consequences of negligence.

Frequently Asked Questions

What made the Bangladesh Bank Heist so significant?

Its significance lies in the sheer audacity of attempting to steal nearly $1 billion with primarily digital tools, bypassing physical security and exploiting a critical global financial network (SWIFT), and nearly succeeding before a simple typo alerted authorities.

Is the SWIFT system inherently insecure?

No, the SWIFT system itself is designed for secure messaging. However, its security is heavily dependent on the security of the endpoints and the credentials used by member banks. The heist exploited vulnerabilities in the banks' own security practices, not the core SWIFT network protocol.

What is the role of the Lazarus Group in such attacks?

The Lazarus Group is a suspected North Korean state-sponsored hacking collective known for high-profile cybercrimes, including financial theft. Their involvement in the Bangladesh Bank Heist is strongly suspected due to their known capabilities and TTPs in targeting financial institutions globally.

How much money was actually stolen?

While the hackers aimed for close to $1 billion, a typo in a transaction request brought the larger transfer to a halt. They successfully stole $81 million before the alarm was raised.

The Verdict of the Engineer: A Digital Autopsy

The Bangladesh Bank Heist is a case study in how critical infrastructure relies not just on complex technology, but on disciplined human processes and unwavering vigilance. The SWIFT network, a marvel of global financial engineering, is only as strong as the weakest link in its chain – often, that link is found in the human element and the security posture of the individual institution.

Pros:

- Highlighted critical security gaps in global financial messaging systems.

- Spurred significant improvements in SWIFT transaction security controls worldwide (MFA, better monitoring).

- Demonstrated the potential for high-impact cyber heists originating from sophisticated actors.

Cons:

- Resulted in a significant financial loss for a developing nation's central bank.

- Exposed the reliance on legacy security practices in some critical financial institutions.

- The Lazarus Group's continued activity poses an ongoing threat.

Ultimately, this incident serves as a stark reminder that cybersecurity is an evolving battlefield. Complacency is defeat. The $81 million stolen is a fraction of the potential loss, but the lesson learned is priceless for those willing to listen and adapt.

El Contrato: Fortaleciendo tu Perímetro Financiero

Now, let's move from dissecting the past to fortifying the future. Your mission, should you choose to accept it, is to review the security posture of your own organization's critical financial systems. Identify one critical security gap that mirrors the vulnerabilities exploited in the Bangladesh Bank Heist—be it weak credential management, insufficient transaction monitoring, or inadequate network segmentation. Document your findings and propose a concrete, actionable plan to address it, drawing inspiration from the defensive strategies discussed. Share your insights, the challenges of implementation, and the expected impact below.